Fortify Your Business Using PayPal’s Risk and Fraud Management Solutions

Jun 05, 2025

6 min read

Fraud is constantly evolving, becoming not only more sophisticated but also more accessible. For every dollar lost to fraud, businesses can incur up to four dollars in total costs, factoring in chargebacks and the erosion of customer trust.

At PayPal, security in the way customers manage their payments is foundational. Our payment systems use AI machine learning, monitoring thousands of signals in real time to help prevent fraud before it occurs. However, the effectiveness of machine learning hinges on the quality of its data. Success starts with integrating clean, relevant data, beginning with signals from your payment provider and enhanced by custom fields to improve detection from the outset.

We'll explore the latest PayPal advancements that help enable you to detect fraud and secure your transactions.

The Power of PayPal: Flexible, Intelligent Payments & Risk Solutions

In today’s digital commerce landscape, growth requires balancing seamless customer experiences with robust security. Businesses need payment solutions that not only drive conversions but also help defend against evolving fraud threats. PayPal’s integrated platform excels by combining smart payment optimization with advanced, data-driven risk management.

Smart Payments and Risk Solutions

At PayPal’s core is one of the largest and most current payment datasets, spanning over 400 million consumer accounts and 20 million merchant accounts worldwide.

This vast data reservoir powers our machine learning models, enabling smart transaction decisions. Our intelligent fraud detection system evaluates transactions using more than 500 data points, from purchase history to device and location, generating risk scores that could detect fraud and help minimize false declines, ensuring a smooth checkout for genuine customers.

Flexible Payments and Risk Solutions

What sets PayPal’s platform apart is its flexibility. Businesses benefit from an open, modular infrastructure that serves as a single point of entry for both payments and risk management. PayPal offers a suite of risk management products tailored to your needs, whether you require basic fraud detection, chargeback protection, or granular risk decision-making tools.

This modularity allows you to scale efficiently, integrating the right level of protection as your business grows or as the threat landscape shifts.

With PayPal, businesses never have to choose between security and simplicity. Our flexible, intelligent solutions empower you to optimize payments and manage risk, all from a single, trusted platform.

Fraud Protection Advanced

Fraud Protection Advanced (FPA) is PayPal’s AI-powered solution that gives risk teams flexible, real-time fraud control. It generates dynamic risk scores for each transaction and provides intelligent recommendations to approve, block, or review payments. Users can create custom filters, add relevant fields, and manage detailed block, review, and allow lists to align with their policies. An intuitive dashboard offers clear insights into transaction trends and fraud patterns, enabling teams to respond swiftly and effectively.

FPA blends automation with customization, keeping businesses ahead of fraud while ensuring smooth customer experiences.

Chargeback Protection

Chargeback Protection (CBP) is PayPal’s advanced risk management solution designed to help businesses reduce fraud exposure and minimize the financial impact of chargebacks on eligible credit and debit card transactions.

Leveraging real-time fraud analysis powered by PayPal’s industry-leading machine learning , CBP automatically approves or declines transactions, helping prevent fraudulent activity and false declines without manual review. When eligible chargebacks for fraud/unauthorized or product not received are received, PayPal waives chargeback fees and does not debit the disputed amount, up to your monthly loss cap, as long as required evidence is provided.

This predictable, scalable protection allows merchants to sell confidently, reduce operational overhead, and avoid costly chargeback fees. CBP is easy to enable within PayPal and Braintree, with no setup costs, integration fees, or risk expertise required.

The Merchant Dashboard provides real-time transparency and analytics, including dispute-level reporting and visibility into your loss cap. With CBP, you can expand to new markets, process orders faster, and keep fraud in check, helping your business grow securely and efficiently.

Dispute Automation

Dispute Automation is PayPal’s robust solution for streamlining chargeback management, enabling businesses to contest disputed transactions and recover lost revenue with minimal manual effort.

At the core, the solution is customizable, along with comprehensive response templates that help ensure all necessary evidence is included, improving the chances of winning disputes. Intelligent decisioning capabilities analyze dispute patterns and recommend which cases are worth contesting, helping businesses avoid wasted effort and optimize operational costs.

The system is built to align with industry standards, including support for Visa’s Compelling Evidence 3.0 framework, enhancing your ability to respond effectively. A low-code integration approach makes it quick and easy to implement, while real-time access to chargeback data enables better visibility and control.

PayPal has documented use cases where our risk and fraud management solutions have improved the financial health of organizations. Let’s look at two such cases.

Case Study 1: Tickeri

Tickeri aimed to expand into new markets and build trust with Latino eventgoers through a seamless, mobile-first payment experience. To achieve these goals, they integrated PayPal’s unified commerce platform, PayPal Open, which delivers both low friction payments and robust fraud protection.

By leveraging PayPal Checkout, Pay Later, and Chargeback Protection (CBP), Tickeri enhanced the customer experience while safeguarding revenue.

The results are compelling: fradulent card transactions dropped by 53%, chargeback disputes fell by 27.5%, and issuer declines decreased by 17%.

With PayPal’s scalable solutions, Tickeri successfully improved ticket purchasing for fans and provided event organizers with a reliable, streamlined payment system, fueling their growth in new markets.

Note: Certain transactions and chargebacks are not eligible for Chargeback Protection. See terms. Chargebacks that are not related to fraud or item not received (INR), such as broken Item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not eligible for Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

Case Study 2: Avelo Airlines

Avelo Airlines needed a scalable and secure payments solution to deliver a smooth checkout experience for customers. By integrating PayPal Braintree and Fraud Protection Advanced (FPA), they achieved stronger fraud management and improved transaction approval rates. As a result, Avelo saw a 3% increase in approval rates and a 15.5% reduction in chargebacks, boosting both revenue and customer satisfaction.

Built-In Fraud Protection with PayPal

Fraud is getting smarter, but so are the tools to combat it. With PayPal’s secure-by-design approach, you gain access to a flexible suite of AI/ML- powered capabilities, all fueled by PayPal’s expansive dataset, to keep your payments safe without slowing down your customers.

The goal: make fraud protection easy so you can focus on growing your business and delighting your customers. When security is built right in, everyone wins.

For more information visit PayPal.AI.

Recommended

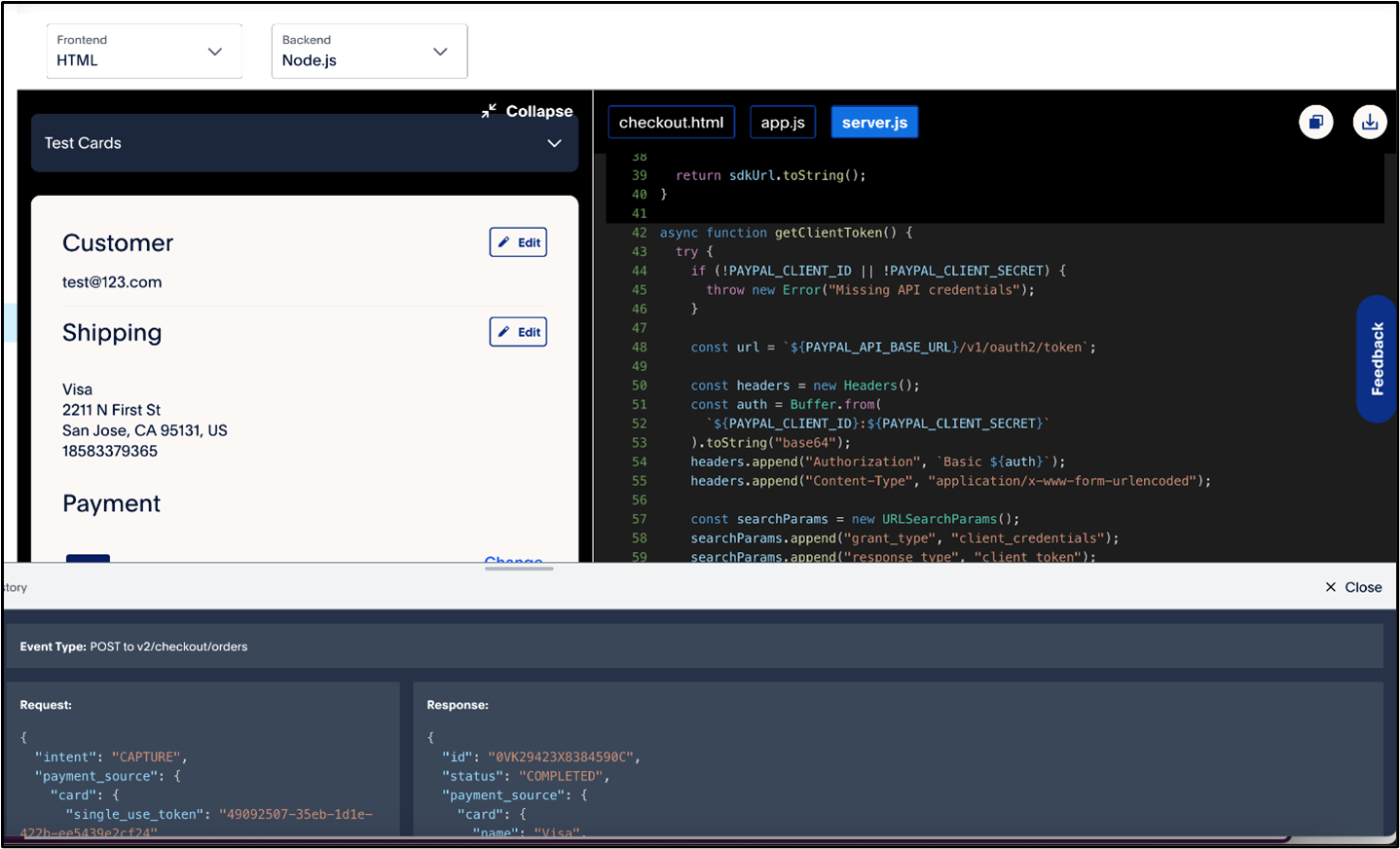

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read